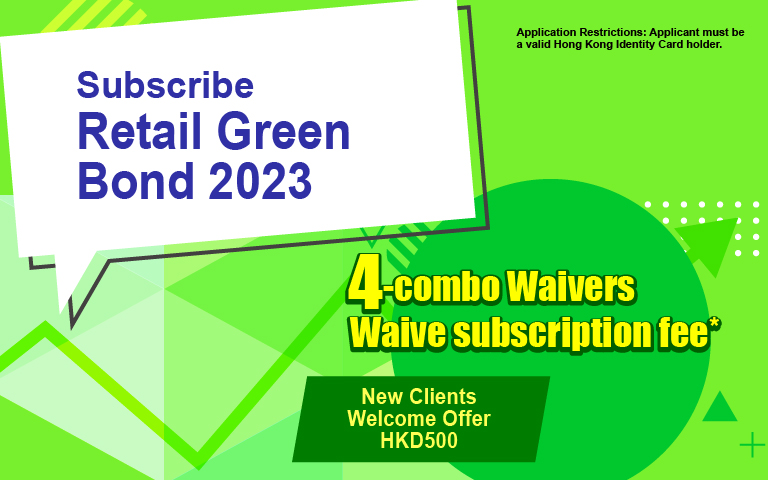

Subscribe Retail Green Bonds () IPO Subscription Fee WaiverOnline subscribe on or before

, 10am

Key Facts about the Retail Green Bonds IPO

| Name |

HK$15 Billion Retail Green Bonds Due 2026 (max HK$20 Billion) |

| Stock Code |

|

| Interest Rate |

Subject to a minimum rate of 4.75% |

| Subscription Amount |

Amount Minimum HKD10,000 (and in a multiple of HKD10,000) |

| Subscription Period |

- |

| Expected Issue Date |

|

| Expected Listing date |

|

| Application Restrictions |

The applicant must be a valid Hong Kong identity card holder. |

| Multiple applications not allowed |

Each HKID card holder may only submit one application. Multiple applications may be rejected in full by the Issuer. |

All BOOM clients who subscribe Retail Green Bonds (

) can enjoy:

| Handling Fee |

| IPO Subscription Fee |

Waive |

| Holding Retail Green Bonds |

| Custodian Fee |

Waive |

| Interest Collection Fee |

Waive |

| Redemption Fee |

Waive |

New Clients Extra Rewards:

| Extra Rewards |

HK$500 Cash Rewards

(For details, please click here) |

| Account Opening Fee |

Waive |

*Terms and conditions applied. Click here for details.

Retail Green Bonds IPO Subscription Special Offer (the "Promotion") – Terms and Conditions

- The Promotion is offered by Boom Securities (H.K.) Limited ("BOOM" or "the Company").

- The Promotion is valid from to with both dates inclusive (the "Promotion Period").

- Subscription Period and Application Cut-off Time

- The tentative subscription period of Retail Green Bonds is from to ("Subscription Period").

- BOOM clients can apply for the Retail Green Bonds IPO via his/her BOOM account before the cut off time of 1pm (for IPO loan) and 10am (for cash application).

- The Subscription Period and IPO loan cut off time can be subject to change.

- BOOM will waive the H.K. IPO Subscription Handling Fee for the Retail Green Bonds IPO application.

- New Clients can also enjoy a waiver of HK$200 Account Opening Fee.

- The Promotion can be used in conjunction with:

- No Minimum Commission for Warrant/CBBC Trading offer (i.e. new clients can enjoy a special rate of 0.0675%, without minimum commission, for all buy and sell trade transaction of Hong Kong warrants and CBBCs, click here for details); and

- Japan Stock Special Commission 0.188% (click here for details).

- Singapore Stock Special Commission 0.188%(click here for details).

- New Clients Promotion (click here for details).

- Except the offer in paragraph 7 above, the Promotion cannot be used in conjunction with any other commission and trading offers (including but not limited to commission waiver, rebates or discount) (if there is any), unless otherwise specified.

Other Terms and Conditions

- According to the issue circular of Retail Green Bonds IPO:

- The applicant must be a valid Hong Kong identity card holder.

- Each HKID card holder may only submit one application. Multiple applications may be rejected in full by the Issuer.

- Important Notes on Subscribing H.K. IPOs:

- There may be restrictions on subscribing an IPO, subject to respective prospectus. In general, the conditions of application for most H.K. IPOs indicate that any application for the benefit of a person within the United States or a US person (as defined in Regulation S under the United States Securities Act of 1933, as amended) is not acceptable. As such, if you are an US citizen, BOOM cannot apply for any H.K. IPO on your behalf.

- A person may only submit one application. Multiple applications may be rejected in full by the Issuer.

- Information on this website is for reference only and is not part of the Prospectus. The securities are offered solely on the basis of the information in the Prospectus.

- General

- All remarks and footnotes stated in any relevant promotional materials shall form part of the promotional terms and conditions.

- In the event of a dispute arising out of offers above, the decision of BOOM shall be final and conclusive.

- Where there is any discrepancy between the Chinese and English versions of the Terms and Conditions, the English version shall apply and prevail.

- No person other than the client and BOOM (which includes its successors and assigns) will have any right under the Contracts (Rights of Third Parties) Ordinance to enforce or enjoy the benefit of any of the provisions of these terms and conditions.

Risk Disclosure (Securities)

- Investment involves risks. Prices of securities may go up as well as down and may even become valueless.

- Investors should not only base on this website alone to make any investment decision, but should read in detail of the relevant Risk Disclosure Statements.

- Investors should seriously consider if investment in the relevant shares is suitable for his/her investment needs by reference to his/her financial position and other conditions and needs before deciding whether to invest in the relevant shares. If required, investors should obtain independent legal, financial and other professional advice before making any investment decision.

Important Disclaimer:

The above content is based on the Issue Circular published in the Government Bond Programme website and is provided for your reference only. You are strongly advised to make investment decisions based on the full information on HKSAR Government and the Retail Green Bonds by reading both the issue circular and the programme circular of the Retail Green Bonds that are available on the Government Bond Programme website.

This website shall not constitute or be regarded as an offer or a solicitation of an offer to buy or sell any security, and no offers or sales of any security will be made in jurisdictions where such offers or sales are not authorized, qualified or exempted from regulation.

The content of this website is issued by BOOM and has not been reviewed by the SFC.