Securities Margin Financing, or Margin Trading, is about using your stock holdings as collaterals to borrow extra funds and buy additional stocks.

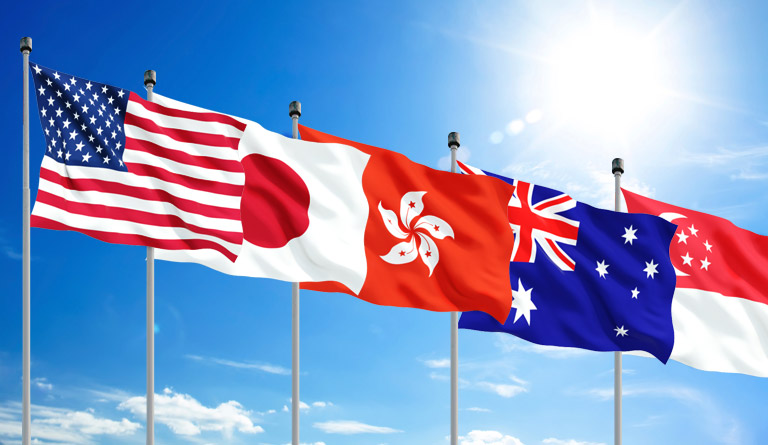

BOOM's margin financing service is so flexible that accepts listed securities in 5 major markets as collaterals. You can use the financing to freely trade across the 18 markets that BOOM offers.

Wide Coverage

We accepts a broad range of securities as collateral

Effortlessly strengthen your buying power with your holdings in the 5 major stock markets!

Over 18,000 stocks listed in Hong Kong, U.S., Japan, Singapore and Australia markets can be used as collaterals for margin financing.

Highly Flexible

You can trade freely across multiple markets

Margin financing facilities available can be used to buy any securities listed on the 18 markets that BOOM offers for trading.

Mark-to-market

Fair valuation of collaterals with high transparency

Valuation of collaterals is mark-to-market. Even the collaterals in your portfolio are listed on different markets, the valuation of each collateral will be reflected in real-time in accordance with corresponding trading hours. Our responsive margin calculation can let you closely monitor your margin positions, anytime and anywhere.

| Market Value | Margin Ratio | Margin Value |

|---|---|---|

$100,000

|

50%

|

$50,000

|

Last Update: July 2018.

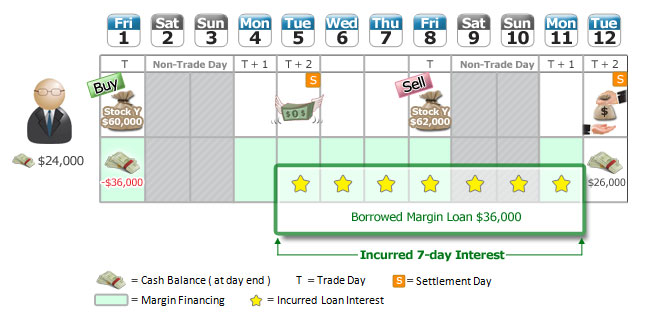

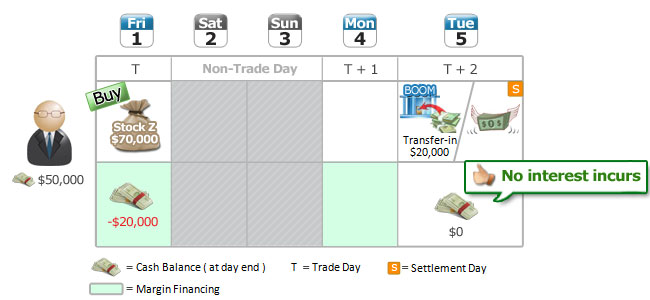

When you trade on margin, you are borrowing money from BOOM against your existing stock holdings to buy even more stocks. Such power of leverage amplifies the stocks' performance – it makes losses and gains greater than investing strictly on cash-only basis.

Before opening a margin account, it is important to be aware of the features and risks associated with margin trading, especially to understand what will happen if the market prices of your stock holdings decline.

BOOM will charge interest on the margin loan at H.K. Prime Rate plus 3 % p.a. or financing cost plus 3% p.a., whichever is higher, and the interest rate applied is subject to change from time to time.

The actual margin interest rate applicable to your margin account is printed on your account statements, under the note section of "Debit Interest Rate".

There will be a margin call when the margin loan (i.e. the amount you borrowed) is higher than the margin value (i.e. the amount of margin financing facility available) in your margin account.

It is generally due to the fall of market price of the marginable stocks you are holding (i.e. the collaterals). When the market value of the collaterals decreases, the margin value of your account will decrease accordingly.

Note: The list of marginable stocks and respective margin ratio, client's margin limit and margin interest rate are subject to change at the BOOM's discretion without prior notice.

|

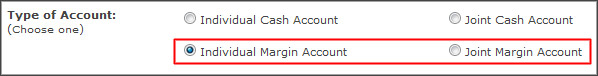

Individual / Joint Account |

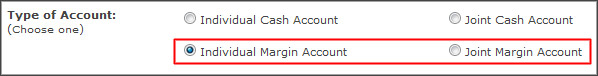

When filling the Account Opening Form, select "Individual Margin Account" or "Joint Margin Account" under "Type of Acount".  Go to "Apply Online" |

|

Corporate Account

|

|

To switch from a cash account to a margin account, simply download, sign and return the form(s) below to service@boomhq.com or by fax at (852) 2255 8300.

|

Individual / Joint Account

|

|

|

Corporate Account

|

|